Amid Rising Costs, Financial Strain Becomes America’s Chief Anxiety

AJ Fabino 11 June 2024

Amid Rising Costs, Financial Strain Becomes America's Chief Anxiety

"As high costs for essential goods tighten budgets nationwide, 65% of Americans now identify financial stress as their primary source of anxiety, eclipsing other personal and professional pressures.

Amid economic uncertainty, a MarketWatch survey of 2,000 Americans defined the effects of financial insecurity on personal well-being, with 88% grappling with some degree of financial stress. High prices of goods, a lack of savings and low income were cited as the primary drivers of stress, which has led 44% of Americans to avoid addressing financial problems until they escalate into crises.

Despite the decline in inflation from its 9.1% peak in June 2022, 47% of respondents said that 2024 has been the most financially stressful year of their lives.

The survey, issued last month, found that financial stress impacts both mental and physical health. About 92% of respondents reported experiencing adverse physical effects due to financial insecurity, including loss of sleep, headaches, and weight changes. Additionally, 41% confessed that their finances have severely impacted their mental health, with many developing unhealthy coping mechanisms.

Millennials, in particular, are feeling the pinch more acutely. Burdened by lower wages and high housing costs, they trail older generations in wealth accumulation. The demographic, aged 27 to 42, reports higher levels of stress, with many feeling that their financial struggles have affected their mental health. The sense of financial fatigue is prevalent, with 64% feeling worn out by their financial responsibilities.

About 94% of those surveyed admitted to sacrificing their mental health to maintain financial stability, often at the cost of their social lives and personal interests. Furthermore, about 30% of respondents said they borrow money without a clear plan to repay it, indicating a cycle of debt that can be difficult to break.

The impact of financial stress extends to family and social dynamics. According to the survey, 58% of respondents admitted to hiding their financial stress from loved ones, often leading to feelings of isolation and compounding their anxiety.

Economic conditions like rising interest rates and high housing costs continue to weigh on Americans. In addition to rising prices, almost half of those surveyed pointed to inadequate savings (47%) and low income (46%) as stressors. About 39% of respondents indicated that economic performance contributes to their anxiety, especially as layoffs have reached a 14-month high."

========================================================================

Lenin is supposed to have said, “The worse things are, the better they are.” It’s another apocryphal quote, but supporters of Trump will not be able to help having that feeling as they read news like this.

The question then becomes, should Trump win the election in November … what should he do about it. (Let’s assume he has a compliant Congress.)

What to do about the border is clear. Build the Wall.

What to do about foreign policy is less clear, but a good heuristic is, ask the neo-cons, then do the opposite.

What to do about the ‘woke’ infection in our educational institutions is complex – we can’t just fire all the indoctrinators. But we can open a multi-front war on them. (Ideas along these lines have been posted elsewhere.)

But what to do about the economy?

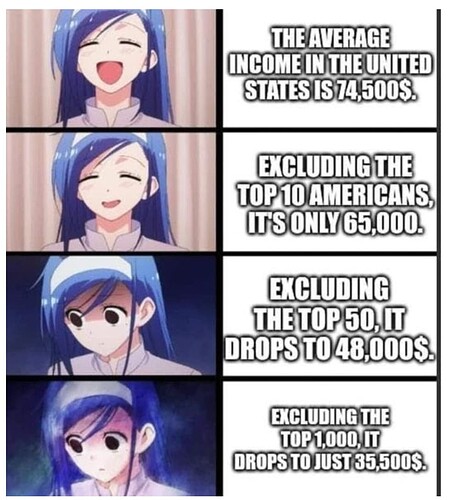

Footnote: (I tutor kids in mathematics, and always stress the importance, when looking at non-normal distributions, of knowing both the mean [ ‘average’] and the median [the ‘halfway-point’] , which is what the above graphic is illustrating. I’m a bit skeptical that things are as bad as this graphic claims – does anyone have other data? This link indicates that it is not as bad as shown in the graphic above, but it obscures the reality by aggregating the middle 25% : Distribution of household income U.S. 2022 | Statista )